There are financial obligations that most new US immigrants (and even some CFPs) are unaware of—including myself.

When I first made the big move to New York last year, no one told me that as soon as I become a US resident, Uncle Sam would stretch his all-encompassing hands into my Malaysian bank accounts and assets.

Not during that defining moment at the US embassy in Kuala Lumpur when I was congratulated by the consular officer with the approval of my visa. And not when I was given a small booklet that outlined the rights of new immigrants and what I should do when a domestic violence incident occurs.

Nowhere in this packet did it mention FBAR, the four-letter acronym that would soon haunt most new immigrants. Neither was it in Welcome to the United States: A Guide for New Immigrants, an official guide published by the US Citizenship and Immigration Services.

What is FBAR?

FBAR stands for Report of Foreign Bank and Financial Accounts, and it is not a form of tax. As the name implies, US citizens and residents must report their foreign bank holdings and financial assets to the Department of Treasury, every year, regardless of whether it earns interest.

According to a Forbes article, it was originally conceived by the IRS to catch tax abuse by American citizens who hide their money in overseas bank accounts.

Unfortunately, new US immigrants (who are now resident aliens) are ensnared in this even if they legitimately earned their money in their country of origin before they moved. They may also be subjected to heavy civil or criminal penalties through no fault of their own, only for the crime of moving to the US.

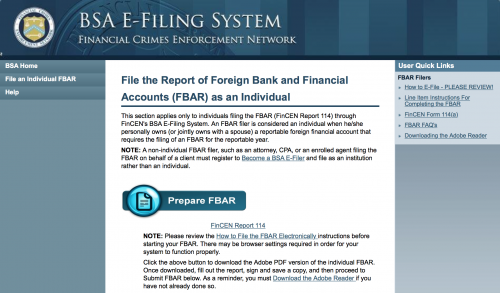

While previously you can paper file form TD F90-22.1, since July 1, 2013, American citizens and residents must now file them electronically. (Though this isn’t a bad thing.)

Must I File an FBAR?

You’re only required to file an FBAR if you have foreign financial accounts exceeding $10,000 at any point in the tax year.

When Is It Due?

By June 30.

For example, if you moved to the US at anytime in 2014, you must file an FBAR by June 30, 2015.

Massive Penalties for Failure to File an FBAR

You stand to be penalized up to 50% of the amount in your foreign financial accounts or $100,000, whichever is the greater of, if you willfully avoid filing an FBAR. Criminal penalties may also apply.

However, if you’re simply unaware that you have to file an FBAR or fail to file the correct form (a “nonwillful violation”), you are still subject to a steep penalty of $10,000 per violation.

What if you fail to file an FBAR because you never knew of its existence? You may voluntarily take part in the Offshore Voluntary Disclosure Program—and you’d still have to pay a 5% – 27.5% penalty on the maximum amount you had in all the years you had your foreign financial accounts.

The unfairness of the FBAR filing requirement for new immigrants is beyond the scope of this article, but it is acknowledged.

How Do I File an FBAR?

You must download Adobe Reader to file an FBAR electronically—no other PDF reader software would work.

Then, visit this link and click on ‘Prepare FBAR.’ A PDF should be downloaded into your local hard drive.

Fill up the PDF using the straightforward on-screen instructions. Make sure you already have all of your relevant documentation and statements to help you file the FBAR accurately.

Once done, click ‘Ready to File’ and watch it upload itself into the ether.

What’s Next?

Apart from filing an FBAR, new US taxpayers must also report their worldwide income (including wages, interest, dividends, etc.) on their tax returns. It’s another topic that I’ll address in a future article.

Ignorance is not the best defense under the IRS’ eyes—even if the IRS makes no effort to educate new US immigrants on their new obligations.

Main image by Great Beyond / CC BY-NC-SA

Pingback: US Taxes on Foreign Income: The Complete Overview