Like snowflakes and DNA, every individual is different.

We have different interests, priorities, and values in life. But the one thing that’s crucial for everyone is to plan for retirement.

In sharing our plan, I hope you’d be inspired to start funding for your retirement as well.

How We Inadvertently Embarked On Our Journey to Financial Independence

Two things have objectively helped me in my quest towards financial independence (FI):

- Marriage:

- The Married Filing Jointly status allows us to combine our various tax deductions.

- Being married to someone who shares similar values helps as we’re both content with our current lifestyle.

- Migration:

- The value of the USD is 4x the value of MYR, and is equally a big factor.

- Though this is offset by living in NYC, “the most expensive place in the world to live” with the highest tax rates in the country.

- The value of the USD is 4x the value of MYR, and is equally a big factor.

Apart from the culture shock that a new immigrant typically faces, one of the most challenging things I’ve faced here is trying to gain employment.

In a city of 8.4 million residents, “stiff competition” doesn’t even begin to describe it.

I continued working remotely for Groupon Malaysia and did some freelance writing gigs on the side, but they barely covered rent.

1. Living Within Our Means

With Matt supporting the both of us mostly on his salary, we went on frugal mode by necessity:

- We stopped the laundry pick-up service (~$20 every two weeks) we were using and started using the coin-operated washing machine in our basement ($1.50). The dryer was barely working, so I did what most Malaysians did to dry their clothes: we bought a clothes rack.

- We started cooking more often dd home while religiously following recipes from Budget Bytes and Good and Cheap. Our groceries these days cost us around $300 per month for the two of us (with the occasional meal out). This saved us from having to spend:

- ~$7 per person: takeouts from the nearest Dominican and Chinese restaurants

- ~$15 – $30 per person: a nice meal at a sit-down restaurant

- I was spending quite a bit on clothes in Malaysia (perhaps also an understatement), but survival took precedence here. The only new article of clothing I purchased at the time was something for the winter: a peacoat.

- We live with roommates, which is significantly cheaper than renting a 1BR or studio apartment.

In short, we started to live simply.

There are always free or inexpensive things to do in the city, assisted by the city’s IDNYC. We also enjoy each other’s company and prefer to hang out at home than at a bar.

And when I found a job, our frugal lifestyle didn’t change, out of habit.

We still dry our clothes in our room. We still cook more often than we eat out. And most importantly, we’re thoroughly content with our existing lifestyle.

2. Avoiding Lifestyle Creep

Lifestyle creep happens when you start to incrementally spend more when you have extra income.

Perhaps you’ll buy new clothes to treat yourself, upgrade your phone when it’s still working fine, or eat out just a little more often.

Before you know it, you begin to slowly adopt this new lifestyle and you start to get used to it.

This is something I try to be mindful of because it’s an easy spiral down into an expensive lifestyle. (Though admittedly, we’ve succumbed to it more than a few times.)

3. Significantly Increasing Savings Rate

Your savings rate is the most important determinant of how early you can retire.

With the additional income while still maintaining the same lifestyle, we shoveled much of any extra money into our retirement accounts, investing in low-fee index funds.

I honestly didn’t think much of it when we started our frugal mode. But our recent calculations pointed towards a savings rate of about 40% – 50%.

This is something we didn’t expect, given that we live in NYC with a ridiculously high cost of living.

Our Projected Year to Financial Independence: 2029

Using FIRECalc—a different flavor of a retirement calculator geared towards those who want to retire early—the projected year for us to safely retire early is 2029.

This is 13 years from now.

The numbers were crunched while taking into account the following:

- Our annual spending amount is adjusted for inflation, so our purchasing power (i.e. our current lifestyle) is preserved.

- This assumes our expenses will remain the same for the next 72 years.

- We continue to maximize our 401(k) and Traditional IRA contributions every year until 2027.

Graph of a Monte Carlo simulation that projects our plan has a 100% success rate based on historical data

Using historical data, FIRECalc factors in financial calamities and volatilities to ensure that our plan can withstand the worst shocks to the stock market.

What was fascinating to me was the Monte Carlo simulation (that models the probability of different outcomes) that showed that this plan has a 100% success rate, assuming my death at 100 years old.

Possible Wrenches

Like many things in life, life may not go as planned.

An online calculator like FIRECalc doesn’t take into account unexpected events that cost money:

- Medical emergency

- Taking care of my youngest brother who has Down Syndrome

- Raising a child, if that ever happens (child care costs in NYC range from $1,300 – $2,500 per month)

- Round-the-world travel plan

I still bank on doing a year-long sabbatical in the coming years. While this will undoubtedly push back our FI plans by a few years, I want to do these travels while I still can.

Since my mum’s passing from cancer three years ago, this has put me on a slightly hypochondriac + YOLO mindset.

What Does Financial Independence Mean?

For us, financial independence means being able to pursue whatever we want.

It means being unshackled from jobs that hold you hostage so that you can pay your day-to-day bills.

It doesn’t mean we have to stop working. It means giving you the freedom to pursue the things that you love to do but not able to now.

For instance, Matt has always loved pandas (I suspect he loved them more than me). His dream is to work with pandas in a zoo, like cleaning up their poop, feeding them bamboo, playing with them, etc.

Being financially independent will give him the opportunity to pursue this very work that he loves.

For me, I’d like to continue to keep my mind active by mastering Mandarin and Japanese, or even learning how to code.

Takeaways

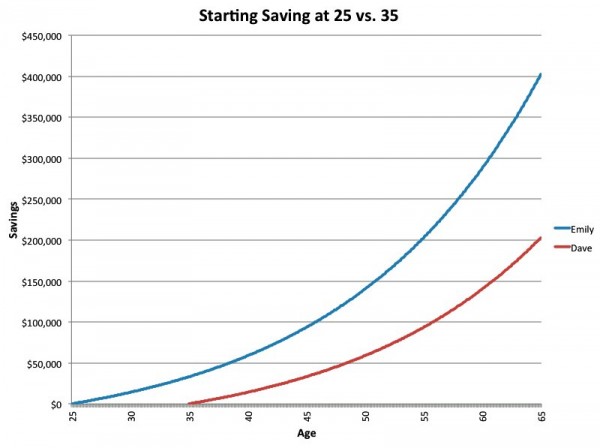

Saving at 25 vs saving at 35 (Business Insider/Andy Kiersz)

To achieve financial independence, we’re taking advantage of the magic of compounding interest by investing in low-cost index funds. This helps us build a passive stream of income to fund our potential early retirement.

If you don’t have an emergency fund that covers at least three months of your expenses (we saved for six months’ worth), start that first.

We’ve also cut back on plenty of expenses we don’t consider necessary. At the risk of sounding like a Zen master, we’re content with the things we have now.

Whether you’re looking to retire early or at a traditional age, the most important thing you can do now is to do an automatic deduction to your retirement or brokerage account. Either your bank or retirement account should allow this.

It’s not too late to begin now. And with long-term investing, the earlier you start, the more likely you’ll have a successful retirement.

Resources

- r/financialindependence: a helpful FAQ on how you can get started

- FIRECalc: early retirement calculator

- Bogleheads: index investing Wiki

There are some great tips here if you want to cash out and retire at an earlier age using your savings and watch it decrease. This method is great, assuming that inflation is stable, and there are no unforeseen events at retirement. Also this method does not really help if you want to leave your little ones an inheritance.

Based on what your readers want to accomplish, it may be beneficial for them to accumulate assets or businesses that are a source of passive income. This will allow them to also take advantage of lower interest rates to purchase more of these types of assets using debt. May be aggressive side but hey YOLO!

Great point Gopi! There are certainly many ways to fund a retirement—early or otherwise—including being an entrepreneur or getting into real estate. I admire those who run their own business, because it’s never easy.

However, not many people are savvy financially. From personal and professional experiences, there’s a large number of people who don’t save (enough), are not saving for retirement, and so on. Many are also risk averse. But certainly, there’s more than one way to arrive at the distant goal of a retirement.

Since we don’t plan to have kids (though this may change in the future), we’re not worried yet about leaving anyone an inheritance. There’s always our life insurance policy.