We’ve all been there.

Right before a big trip overseas, we visit banks or money changers to buy our destination’s local currency. Often enough, anything related to foreign cash is mired in any combination of the following:

- ATM (bank) fees

- dynamic currency conversion fees

- foreign currency conversion fees (for debit and credit cards)

- poor exchange rate

Is it possible then to avoid paying these fees?

Yes, if you’re a US resident. Options are more limited for non-US residents however, but you can still minimize them.

Avoiding ATM (Bank) Fees

For US residents:

To completely avoid both ATM fees and foreign transaction fees, there’s only one option in the US that fulfill these criteria.

And that’s Schwab Bank High Yield Investor Checking Account.

Image from tales of a wandering youkai / CC BY

When I first learnt about Schwab, I thought there must be a catch for what seems to be unrivaled benefits. At the time of writing, no other big bank comes close to this.

Take a look at some of its features:

- no monthly service fees

- no account minimum

- unlimited fee rebates from any ATM worldwide

- no foreign exchange transaction fees for purchases made with its debit card

- no extra fee added to the foreign currency conversion when you withdraw foreign currency from an ATM, which means you get the foreign currency at prevailing market rate

Imagine traveling to London or Hong Kong and then withdrawing the foreign currency from an ATM—it’s like having your own personal money changer in your wallet.

But what’s the catch?

I pored through their fee schedule and truly couldn’t find anything negative outright. The only (minor) drawbacks are:

- they’ll do a hard pull on your Equifax credit report when you first sign up for an account

- they only allow domestic US wires, so you can’t receive or send money internationally

I can live with this.

Those myriad bank fees and an exchange rate that’s never in your favor can accumulate to hundreds and even thousands of dollars over time.

For non-US residents:

Only a few banks in other countries allow you to withdraw money from ATMs worldwide for free:

- Australia

- Citibank Australia’s Citibank Plus account, though it charges a 2.5% international transaction fee

- Germany

- Deutsche Kreditbank’s (DKB) DKB Cash account comes with a DKB Visa card. They don’t charge any foreign transaction fees either, which is a great equivalent to America’s Schwab

Image from Sascha Kohlmann / CC BY-SA

Additionally, if you have access to a bank under the Global ATM Alliance, you won’t be charged an international ATM fee when withdrawing from partner ATMs.

Unfortunately, this doesn’t mean that you won’t get slapped with foreign transaction fees. I’m loathe to recommend this if you have other better options, like a credit card with no foreign transaction fees.

Participating banks in this alliance include:

- Bank of America (United States)

- may still charge you a fee in certain countries

- Barclays (United Kingdom, France, Spain, Portugal, Pakistan, Gibraltar, and some countries in Africa)

- BNP Paribas (France)

- Banca Nazionale del Lavoro (Italy)

- Deutsche Bank (Germany, Poland, Belgium, India, Spain, and Portugal)

- Scotiabank (Canada, Mexico, Chile, Peru, Guyana, and the Caribbean)

- Westpac (Australia, New Zealand, Fiji, Vanuatu, Cook Islands, Samoa, Tonga, Papua New Guinea, and Solomon Islands)

- ABSA (South Africa)

- offers a reduced rate only

- UkrSibbank (Ukraine)

- offers a reduced rate only

Fees may still apply in specific situations or when withdrawing from certain countries listed above. You should still do your due diligence before choosing to do this.

Say No to Dynamic Currency Conversion

Something that emerged in recent years is dynamic currency conversion (DCC). These are fees that can be levied when you’re traveling abroad and are charged in the currency of your home country.

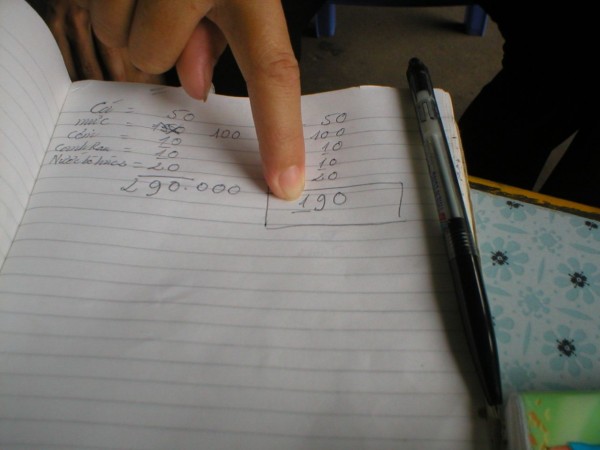

Let’s say you’re backpacking in Vietnam and have an American credit card. DCC is when you’re charged in USD instead of VND (Vietnamese Dong).

When the merchant converts VND to USD, this is at a rate that’s always worse off than if you had charged the credit card in VND—it can be up to 7% of your purchase price.

Image from Jonathan Haynes / CC BY-SA

While you’re supposed to be asked, “USD or [local currency]?”, the merchant—be it hotels, restaurants, or retail stores—may even have surreptitiously charged you via DCC without asking you.

Note that DCC fees are a revenue source for merchants, which is why they may be eager to convert the local currency to USD for you.

To add insult to injury, your credit card company may even charge an extra fee for using the credit card overseas.

Get Credit Cards with No Foreign Transaction Fees

It’s not farfetched to say that the US has a thriving banking landscape that benefits savvy consumers, compared to other countries.

That means if you pay off your statement balance responsibly every month, you can benefit from what a credit card may provide:

- bonus points or miles

- car rental insurance

- price protection against lower prices after purchasing an item

- extended warranty

- no foreign transaction fees (or foreign currency conversion fees)

For the latter, this means that if you’re ever traveling abroad and need to purchase something in a foreign currency, you can buy it freely without needing foreign cash.

Image from Sean MacEntee / CC BY

Here’s a list of some well-known cards in the US that don’t charge foreign transaction fees:

- American Express Platinum

- American Express Business Platinum

- Bank of America’s BankAmericard Travel Rewards

- Barclaycard Arrival Plus World MasterCard

- Barclaycard Arrival

- Barclays US Airways MasterCard

- Get 50,000 bonus miles after first purchase and payment of $89 annual fee.

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Chase Sapphire Preferred

- Get 40,000 bonus points when you spend $4,000 in the first 3 months from account opening + 5,000 bonus points after you add an authorized user. Apply by June 30, 2015.

- Chase Sapphire Reserve

- Citi ThankYou Premier

- Citi Prestige

- Citi Executive AAdvantage World Elite MasterCard

- Chase British Airways Card

- Chase Hyatt Card

- Chase IHG Rewards Club Select Credit Card

- Chase Marriott Rewards Premier

- Chase Southwest Rapid Rewards Premier

- Chase United MileagePlus Explorer

- Chase United MileagePlus Club Card

- Discover it

- Get $50 cashback bonus with your first purchase within 3 months + free FICO score (TransUnion) monthly.

- Discover it Miles

- Hawaiian Airlines World Elite MasterCard by Barclaycard

- U.S. Bank SKYPASS Visa Signature Card

- Wells Fargo Propel World American Express Card

- Wells Fargo Propel 365 American Express Card

My personal favorite card to use would be Chase Sapphire Preferred, as its Ultimate Rewards points are one of the most valuable around (with 11 transfer partners such as Korean Air and Singapore Airlines). It also earns 2x points for travel and dining.

For non-US citizens, you do have options if you live in one of the following countries:

- Australia

- Click here for a list of Australian credit cards that don’t charge foreign transaction fees

- Canada

- UK

- Click here for a list of UK credit cards that don’t charge foreign transaction fees

Getting the Best Exchange Rate

Depending on where you live, you may have access to products that don’t charge you ATM fees or foreign transaction fees.

Even if your country’s banks don’t offer these types of benefits, here are some quick tips to make sure you get the best exchange rate always:

- Avoid money changers in the airport—you’ll almost always get the worst deal as there’s not a lot of competition there.

- Withdraw foreign cash from an international ATM as this is based on wholesale exchange rate, though make sure that the debit card you’re using is charging the lowest possible international ATM fee in your country. This is much better than going to money changers or using traveler’s checks as they often offer terrible exchange rates and charge a commission on top of that.

- If you’re going to withdraw cash from an ATM, use the ATM from a major bank. ATMs in odd locations like hotels and grocery stores often charge higher fees and give you worse exchange rates.

It’s easy to disregard all kinds fees if you think they’re not a lot. But add them all up, and you could’ve bought yourself a domestic flight somewhere.

Do you have any experience in cutting down on fees when traveling abroad? Share with me your thoughts or tips below.

Main image from epSos.de / CC BY

Thanks for sharing these great tips on how to avoid ATM fees when traveling. It is definitely important to do research so you are not spending money you don’t have to!

No problem Lauren. I agree, you should definitely do your own research as well to avoid paying all these fees!